PROFESSIONAL INDEMNITY INSURANCE

- Specialist expertise to provide support during a claim

- Wide range of coverage limits (£250k to multi-million pounds)

- Legal costs covered - legal defence and associated costs even when case settled with no award

- Tailor made for your needs

Professional Indemnity Insurance

Professional Indemnity Policies offer protection against claims in relation to breach of professional duty or errors and omissions. Did you know that often it’s needed to satisfy contractual or regulatory requirements?

We’re here to help

In a Nutshell…

A Professional Indemnity policy will offer protection to the policyholder in relation to claims brought by third parties in respect of circumstances such as mis-advice, faulty design or professional error and omission – essentially any situation where a professional service is being provided for a fee.

The allegation of professional negligence may or may not be proven but a Professional Indemnity policy will typically cover the cost of defending the action as well as any claim award in the event that the third-party claim is upheld.

What do I need to know about Professional Indemnity Insurance? FAQs

What is Professional Indemnity Insurance and why do I need it?

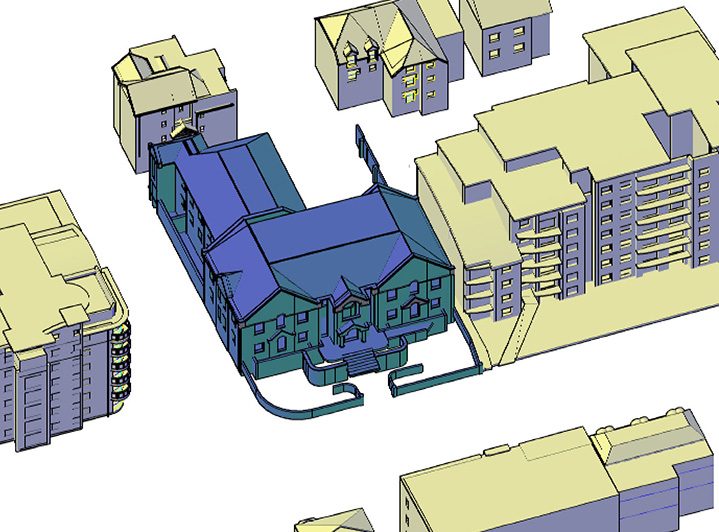

Any business offering a professional service will, to varying degrees, carry a professional indemnity risk. ‘Professional service’ naturally has a broad definition and might include advice, consultancy, and/or design. For example, an architect may mis-design an extension, a structural engineer may miscalculate the need for a load bearing beam, a letting agent may mismanage a property or an accountant may mis-file accounts. All of these scenarios could give rise to a Professional Indemnity claim.

The need for Professional Indemnity cover is commonly driven by three principal factors:

- Contractual requirements – evidence of suitable cover required in order to transact business with another party or client

- Regulatory obligation – required by the industry regulator or body (for example, RICS in relation to surveyors & estate agents and the FCA in relation to financial services)

- Peace of mind – the business owner wants access to the support of an insurance company in the event of a mistake being made or something going wrong

What are the risks associated with not having Professional Indemnity Insurance Cover?

In the absence of a valid insurance policy, the business would not be in a position to call upon the expertise and financial support of an insurance company in the event of a Professional Indemnity claim.

The level of professional cover varies from business to business and indemnity limits typically range from £250,000 to £5M (although even £10M is becoming increasingly common). In some cases, it can be debatable whether the level of cover held or required bears relation to the likely risk but, as with many forms of insurance, the potential size of a claim can be a ‘piece of string’ scenario. It is important to remember that the Professional Indemnity policy will cover both the associated costs of defending the claim as well as the cost of any award (if the claim is successful).

The absence of suitable Professional Indemnity cover could leave a business financially exposed in the event of a claim, irrespective of whether the third party’s allegations have merit, without the funds to either defend itself or absorb the loss. In some situations, the business might also be considered to be in breach of contract which might have wider implications for the customer relationship.

What happens if I need to make a claim?

In respect of Professional Indemnity Insurance, there is often a distinction to be made between awareness of a claim ‘circumstance’ (that is, a situation from which a claim might materialise) and a formal claim. In either case, the insurers need to be made aware and will offer guidance and support as soon as a claim circumstance is known or a notification is received.

In conjunction with Fairweather Insurance, you will be given guidance by the insurer in terms of how to respond to whatever correspondence is received and supported through the process until the matter is resolved.

At Fairweather Insurance we are acutely aware that a claim situation can be one of the few occasions where a customer’s insurance policy can become of tangible benefit. In many cases, a claim will be the result of a serious or distressing event. Accordingly, we recognise the importance of supporting our clients when a loss or incident occurs and doing all we can to help manage claims in a prompt and efficient fashion. To this end, we have a dedicated Claims Team whose sole focus is to support our clients during the process and manage claims through to their conclusion.

How do I arrange cover?

Whilst off-the-shelf products are available online, they may not adequately address or be suitable for the risks specific to an individual business and a more bespoke solution is often needed. It is therefore a good idea to utilise the services of an insurance broker.

Professional Indemnity Insurance is not a homogenous product, with various policy types available which are tailored for the requirements of different industries – ‘Technology’, ‘Marketing’, ‘Design & Construct’ and ‘Management Consultants’ are all distinct forms of Professional Indemnity coverage. Different insurers specialise in different sectors and industries.

We have access to an array of insurers across the market which can cover a wide spectrum of risk sectors and industries. Accordingly, we are confident of identifying a suitable insurer and sourcing an appropriate policy irrespective of how complex or niche the risk might be.

There are also various options in terms of how Professional Indemnity policies operate, which need to be understood. Consideration also needs to be given to policy features such as excess levels, as well as an understanding of any conditions and exclusions that may apply to the policy. We will explore and explain the options to ensure you understand the policy features and that what we are proposing is suitable for your requirements.

For these reasons, we recommend you seek professional advice… and speak to Fairweather Insurance. One of our knowledgeable and friendly team would be delighted to discuss your requirements with you.

At Fairweather Insurance, we have been providing the highest levels of service for many years. It’s our experience and passion for outstanding service that sets us apart.

Why Choose Fairweather Insurance?

At Fairweather Insurance, we pride ourselves on providing an Outstanding Service with a Personal Touch. We have been finding solutions to even the most complicated insurance requirements for over 35 years now.

Our experienced team, work relentlessly to make this happen using their vast knowledge base and strong relationships with insurance providers. Never losing site of our Core Values.