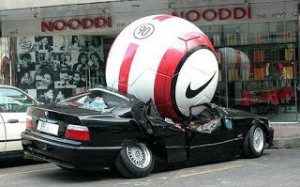

According to research by AXA reported in the Insurance Times a significant amount of clients cannot afford the policy excess in the event of an accident. AXA are warning motorists against inflated ‘voluntary’ excesses which are sometimes requested in order to bring the premium down. We all dread the time when it comes to make a claim but it is what we get insurance for (not just because we have to). Its not when you take out the policy that it really counts but when you have to make a claim – perhaps following impact from a giant football?

Research suggests that 48% of the population have readily available savings of less than £500 and 34% have as little as £200 or even less. According to AXA’s research 62% of motorists are aware that a portion of their excess is ‘voluntary’ and have selected the limit themselves to benefit from a premium saving however whilst it might make the premium affordable the excess is not. This worries insurers and motoring bodies alike as it means there are likely to be many unrepaired vehicles on the road.

Perhaps more worrying is AXA’s claim that 17% of motorists don’t know what type or value of excess they have.

Often these comparison websites are misleading and at the very least do not go far enough to explain the benefits and drawbacks of higher excesses. We understand that not everyone is on a footballers salary and so our priority is to ensure that you have a policy that is reasonably and appropriately priced but that you can be sure will respond as expected in the event of a claim. This is why a Broker can be of invaluable service getting you the cover you need at the most reasonable price.

Alistair